Rules To Sustain Wealth

What Are The Rules To Sustain Wealth?

The Rules to Sustain Wealth help people make good decisions and enjoy the quality of life they want. In everything you do, make sure to revisit these rules. They are:

- Prepare Your Wealth, so It Supports Your Quality of Life.

- Prioritize Your Wealth, so It Fulfills Its Purpose.

- Plan Your Wealth, so the Odds Are in Your Favor.

Prepare Your Wealth, so It Supports Your Quality of Life

Your quality of life depends on a steady flow of income, regardless of what the market is doing, what Congress does with our tax laws, or our quality of health. To sum it up, “always keep income coming in.”

Preparation comes from anticipation. If you know something might happen, it makes sense to have a strategy. For example, if the markets go up next year, you’ll probably be okay with taking income, right?

However, if the markets go down or crash, many people would be stuck making a difficult choice. If they take income from their assets while they are down, they could be compromising their retirement. The following scenario is an example of the consequence of pulling money out of an account that has lost money. This is called the sequence of return risk.

Let’s say you have $1,000,000 in retirement, and you need $40,000 a year to support yourself. Your account makes 6% ($60,000) in year one, and you take $40,000. No problem because the account went up. You drew income from an account that made money.

Now let’s do that again, but your account dropped 6%. Your $1,000,000 is now $940,000. On top of the loss, you take $40,000 as income, which puts your balance at $900,000. That’s a 10% total reduction.

If your account goes down 10%, it’ll take 11% or so to recover. If your account goes down 20%, it’ll take a 25% return to break even. Finally, if your account goes down 40%, which can happen, it would take a 66.7% return to get back to where you started. The bigger the drop, the more difficult the recovery. Now imagine if you had back-to-back annual losses while taking your $40,000 as income.

When you take income from an account that has lost money, you accentuate the loss and ultimately compromise your income for retirement. Hoping for a swift and strong recovery is wishful thinking. People win the jackpot in Vegas every day, but would you bet your retirement on those odds?

This principle does not suggest that you lock up 100% of your assets in Annuities, Bonds, CDs, or any other asset that can’t lose money. Instead, it suggests that when an account is down, you pull money from other sources (protected) until it has sufficiently recovered.

Want A Rooted Wealth Plan That’s Designed To Support Your Quality Of Life?

Click “Get Started” Today!

Prioritize Your Wealth, so It Fulfills Its Purpose

Years ago, I met a man who was in a situation where his pensions covered more than he needed to sustain the quality of life that he and his spouse wanted. They did not need any support from their investments (stocks, mutual funds, ETFs, etc.), so they decided to invest their remaining assets in the market. The final sum of their total assets would, upon death, pass to their heirs based on the instructions in their trust.

Some people may scratch their heads regarding the strategy; however, the couple followed rule #2. Their wealth was prioritized according to their desires. If they required those funds to support their quality of life, they would not have invested in that manner.

The takeaway is prioritizing your wealth based on what you want it to do.

You can protect appropriate boundaries and integrate balance into your life and retirement planning by following this list.

- You

- Your spouse/partner

- Your children

- Your grandchildren

- Your community (church, association, club, etc.)

Within each group, consider the following:

- Is money moving in or out of your account(s)?

- What is the asset qualification (qualified pre-tax, qualified tax-free, non-qualified)?

- What are the tax consequences?

- What is the risk exposure?

- What is the timeline expectation?

- Will this group affect other groups based on how it is being managed?

Beware of the “bleeding-heart” retirement. A bleeding-heart retirement is when too much is given to the children, grandchildren, or other groups, that the retirement goals, accumulated wealth, and quality of life are compromised. Prioritization can help you protect your quality of life while still getting the most out of your wealth.

Want To Get Your Wealth Prioritized?

Click “Get Started” Today!

Plan Your Wealth, so the Odds Are in Your Favor

There is only so much you can control. One step within this rule is to always plan for what you can control and develop a strategy for what you can’t control. The markets will do what they will do. Congress will pass what it will pass. No matter how hard you try, your health will eventually erode. All of this is a part of life.

When you focus on what you can control, you significantly increase your probability of success. For example, you can’t control the future tax rates and laws associated with them. However, you can proactively minimize your tax exposure, so possible future changes affect you less if or when they happen.

Planning for a down-turning market is encompassed in the rule, “Prepare Your Wealth, so It Sustains Your Quality of Life.” The market has a historical pattern of crashing every seven or eight years. Here’s an account of the major crashes since the year 1900*:

- 1903 – Rich Man’s Panic (-21%)

- 1906 – General Panic (-34%)

- 1911 – WWI / Influenza (-50%)

- 1929 – Great Depression (-79%)

- 1937 – WWII (-49%)

- 1946 – Post War Bear Market (-37%)

- 1961 – Cold War / Cuban Missile Crisis (-22%)

- 1965 – Recession (-22%)

- 1968 – Inflation Bear Market (-36%)

- 1972 – Inflation / Vietnam / Oil Crisis / Nixon (-51%)

- 1982 – Stagflation Crash / Paul Volcker (-27%)

- 1987 – Black Monday (-34%)

- 1990 – Iraq Invaded Kuwait Crash (-20%)

- 2000 – The Dotcom Crash (-49%)

- 2008 – The Housing Crisis (-56%)

- 2020 – COVID-19 Pandemic (-34%)

In addition to market crashes, there also seems to be a historical pattern of the market going flat — producing 0% returns on average over ten years or so. Here’s the past one-hundred-year timeline of flat markets**.

- 1909–1921 (13 years flat)

- 1929–1944 (16 years flat)

- 1965–1974 (10 years flat)

- 2000–2010 (11 years flat)

No one knows when the next market crash will hit or when the next flat market cycle will start. If you end up enjoying a thirty-year retirement, there’s a good chance you will experience at least one flat market cycle and around three or four market crashes. The first step in this rule is to accept this probable reality.

Another step within this rule is to take a neutral position regarding your investment options when planning your wealth to have the right investments available, regardless of market direction. It’s not unusual for someone to complain about a specific investment and, in their frustration, cherry-pick facts out of context and inaccurately describe how the investment works. They focus on the bad and can’t explain the good. This creates a problematic shortlist of investment options.

There’s no such thing as a perfect investment. Everything has its benefits and its detriments. Being neutral or open about your investment options and plan allows you to see what is possible.

Remember, no one can make you do anything. You have all the power. Economists often point out that the “masses” are often without their “m.” Researchers have shown that few of life’s important decisions are logically made. Instead of blindly following the masses, pause, ask questions, stay neutral, be open to what is right instead of a strongly voiced opinion (who is right), and make the best decision based on your criteria for tomorrow.

Following well-ground rules and principles, gives you the highest probability of making sound financial decisions.

The third and final step of this rule is to stay focused on the solution. Giving all of your energy to the problem makes it worse. Anxiety is trying to predict tomorrow based on one’s immaculate perception. Stress is an over-focus on yesterday. It can be easy to worry about the next market crash or the pending tax bill, but there’s not much you can do to change it at the end of the day. Stay in the now, and prepare for tomorrow by following the proven rules and principles of finance.

Fear becomes a constant companion when one focuses solely on problems, and fear-based problem-solving usually leads to poor decisions. And not just in finances. Solution-based preplanning gives you peace of mind knowing you have a strategy during the best and worst of times. Planning is a forward-facing activity. What does your future look like?

Want To Put The Odds In Your Favor?

Click “Get Started” Today!

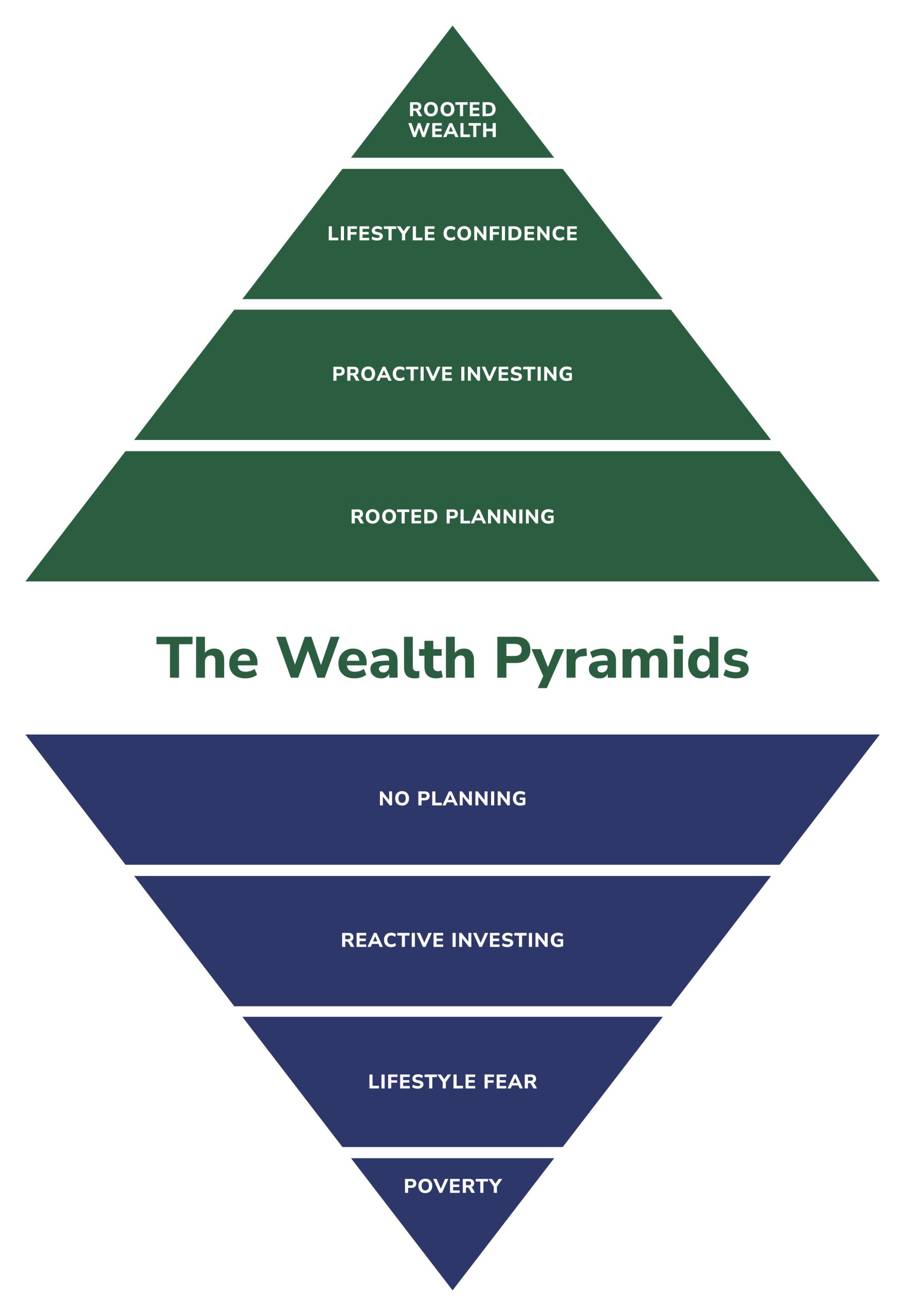

The Wealth Pyramids

When you implement the three described rules, you climb the Wealth Pyramid. We have found that those who don’t follow these rules typically travel in the opposite direction of wealth and security. Consider the Wealth Pyramids below.

Achieving wealth is insufficient if one doesn’t have a system to support accomplishing the goal. Wealth, by definition, is having enough—enough time, money, resources, love, kindness, fulfillment, friends, etc.

Let’s use weight loss to illustrate this point. Many folks eat as a source of comfort, and when trying to lose weight, their failure results in added frustration. The added frustration means they need to be comforted, so they eat to feel better.

The cycle of constantly failing to lose weight stems from failing to plan and implement habits to support the plan. In other words, without a plan and the habits to support that plan, statistically, people typically gain weight while trying to lose weight.

Those who follow the rules of wealth create a plan (proactive investing) that builds confidence in their way of living and eventually leads to wealth. On the other hand, those who fail to plan (follow the masses) move to reactive investing, which is fear-based, and commence down the pathway toward poverty. Poverty is defined as a “lack of”—a lack of time, money, resources, love, kindness, fulfillment, and friends. These individuals are not enjoying the quality of life they want.

Are You Ready To Build A Plan Designed To Sustain Yourself And Your Wealth?

Click “Get Started” Today!

7 Steps to a Successful Retirement

How to Confirm Your Retirement Is Designed to Support the Quality of Life You Want for 30+ Years

7 Essential Steps to Take Before You Retire

How to Prepare for a 30+ Year Retirement

Learn the Rules to Sustain Wealth

Think All You Need Is Income? Wrong!

How to Sustain Your Wealth, Even in a Crash

The Truth About Tax Planning

Discover What Lifestyle Planning Actually Is

All You Need Is a Good Portfolio, Right? WRONG!

Why Your Advisor May Not Be Enough

BONUS: Exclusive Access to the Growing You Wealth Newsletter

* Notable Market Crashes

- Kaplan, Paul, “In Long History of Market Crashes, Coronavirus Was the Shortest.” Morningstar, Mar 9, 2021, https://www.morningstar.com/articles/1028407/in-long-history-of-market-crashes-coronavirus-crash-was-the-shortest. Accessed Feb 6, 2022.

- Neufeld, Dorothy, “How the S&P 500 Performed During Major Market Crashes.” Visual Capitalist, Aug 5, 2020, https://www.visualcapitalist.com/sp-500-market-crashes/. Accessed Feb 6, 2022.”

- “List of stock market crashes and bear markets” Wikipedia, n.d.,https://en.wikipedia.org/wiki/List_of_stock_market_crashes_and_bear_markets. Accessed Feb 6, 2022.

** Dr. Robert Schiller Data – Online Data Robert Shiller, n.d., http://www.econ.yale.edu/~shiller/data.htm. Accessed Feb 6, 2022.